Dissecting the most recent price action for TLT & IEF. Key price levels to monitor

Overview: the most recent rally within an extended secondary (bearish) reaction has set up TLT and IEF for a potential primary bear market signal. The trend remains bullish to this day, but if the key prices I show in this post are jointly pierced, a new bearish trend will be signaled.

General Remarks:

In this post, I extensively elaborate on the rationale behind employing two alternative definitions to evaluate secondary reactions.

TLT refers to the iShares 20+ Year Treasury Bond ETF. You can find more information about it here

IEF refers to the iShares 7-10 Year Treasury Bond ETF. You can find more information about it here.

TLT tracks longer-term US bonds, while IEF tracks intermediate-term US bonds. A bull market in bonds signifies lower interest rates, whereas a bear market in bonds indicates higher interest rates.

A) Market situation if one appraises secondary reactions not bound by the three weeks and 1/3 retracement dogma

As I explained in this post, the primary trend shifted to bullish on 6/4/24.

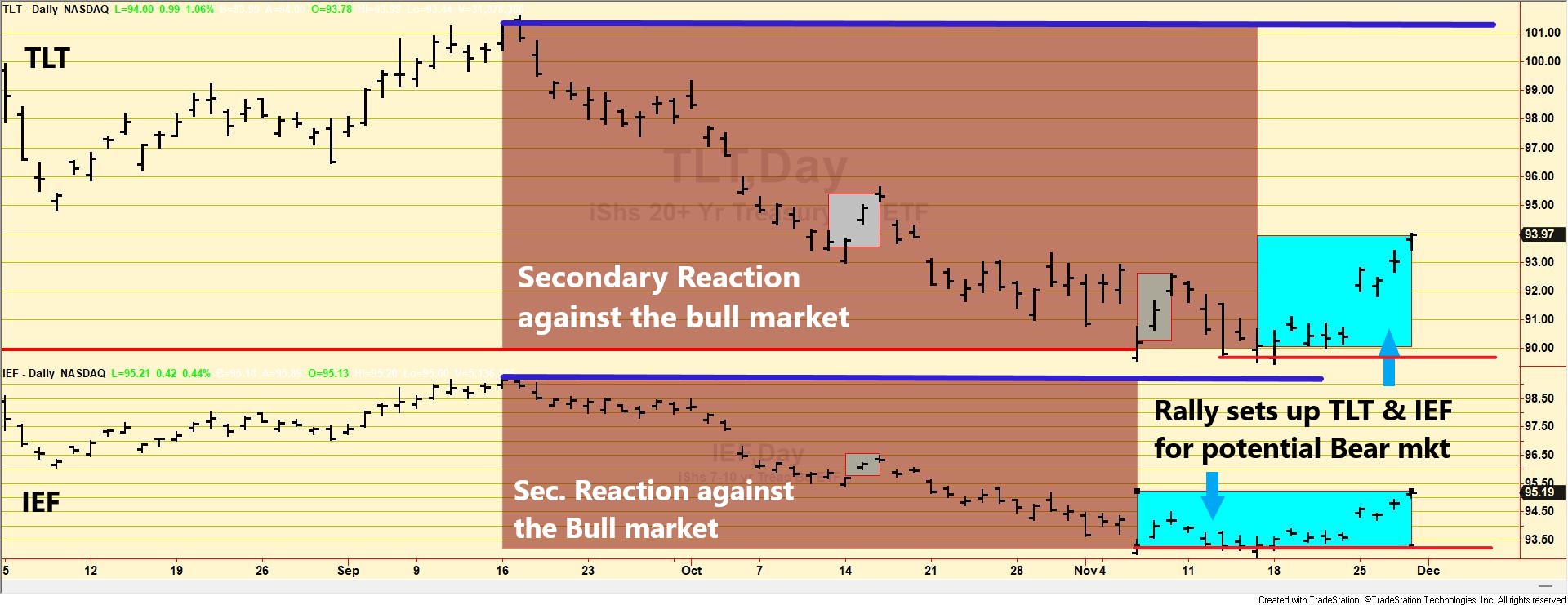

Following the 9/16/24 highs, there was a substantial pullback until 11/6/24 (TLT) and 11/15/24 (TLT). This pullback amply met the time and extent requirements for a secondary reaction.

On 11/13/24, TLT violated its 7/1/24 lows unconfirmed by IEF, so no primary bear market was signaled. Thus, the primary bull market remained intact. The 7/1/24 lows are the lows of the “last completed secondary reaction” (not the current one, but the one before that was successfully terminated by higher highs). The lows of the last completed secondary reaction also serve as relevant price levels to signal a trend change when we don’t have another option at a higher price level.

A rally ensued after the 11/13/24 (TLT) and 11/6/24 (IEF) lows. This rally also met the time and extent requirement to set up both ETFs for a potential primary bear market signal.

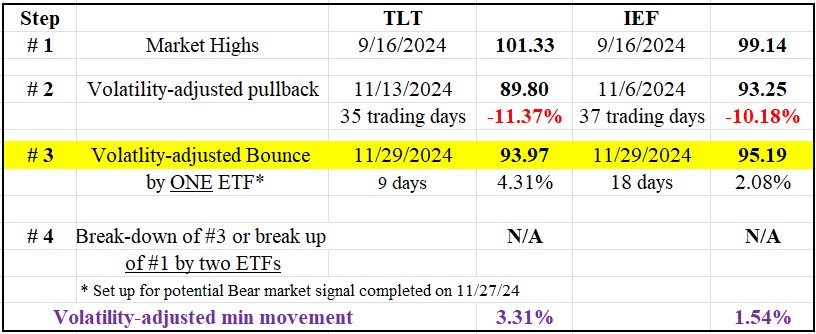

The table below gives you the relevant dates and prices:

So, now the situation is as follows:

1. A primary bear market will be signaled if TLT and IEF jointly pierce their 11/13/24 (TLT, at 89.8) and 11/6/24 (IEF, at 93.25) closing lows.

2. The primary bull market will be reconfirmed, and the setup for a potential bear market signal canceled, if TLT and IEF jointly surpass their 9/16/24 closing highs.

The following charts depict the latest price movements. Brown rectangles indicate the secondary (bearish) reaction opposing the ongoing primary bull market. Blue rectangles highlight the recent rally that fulfilled the setup for a potential primary bear market (Step #3). Red horizontal lines mark the secondary reaction lows (Step #2), while blue horizontal lines show the primary bull market peaks. A breach of these peaks would reaffirm the primary bull market, though this scenario appears unlikely in the near term.

Therefore, the primary trend is bullish, and the secondary trend is bearish.

B) Market situation if one sticks to the traditional interpretation demanding more than three weeks and 1/3 confirmed retracement to declare a secondary reaction.

As I explained in this post, the primary trend was signaled as bullish on 7/31/24.

The most recent pullback meets the time (>=15 trading days) and extent requirement for a secondary reaction. And the most recent rally, has also set up TLT and IEF for a potential primary bear market signal.

In this instance, the long-term application of the Dow Theory coincides with the shorter-term version, so there was a secondary reaction against the primary bull market and the most recent rally set up both ETFs for a potential primary bear market signal.

Sincerely,

Manuel Blay

Editor of thedowtheory.com